Opinion: Summary of council's debt levels and what is driving them

.

■ As the new council gears up for the new triennium, Philip Jacobs takes this opportunity to remind you of the current state of Whakatāne District Council’s finances, best evidenced by ballooning debt

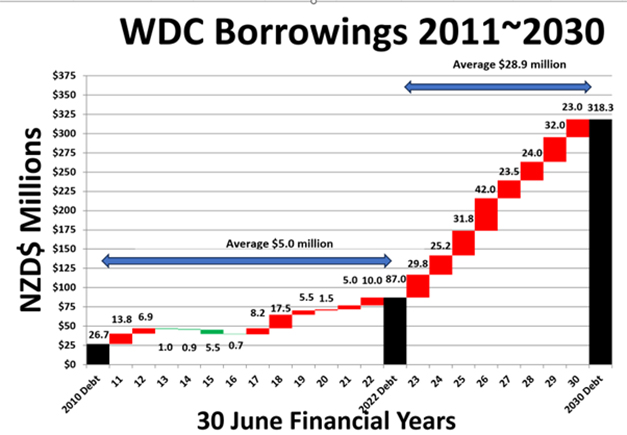

This was my debt graph, pictured top, that was published in the Beacon on August 21, 2024 after the 2024-34 long term plan was finalised.

The same day the Government announced Local Government reform (targeting excessive spending), and that is still being progressed.

The primary concern is the sudden uplift in council debt increases (from $5 million per year to $30 million per year) during the term of the last council and the fact that it is ongoing.

In August last year, I did not fully understand the drivers of the rapid uplift in debt. But it is clear now that it is about 50 percent driven by council’s operating deficits, which are expected to continue long term.

However, as pointed out by Audit New Zealand, council’s forward estimates of its debt levels in the long-term plan were contrived.

“The council reduced its planned capital expenditure on Three Waters compliance and resilience-based projects by between 30 percent and 50 percent, due to significant funding constraints.

“The council did not make a corresponding adjustment to the scope of individual projects and could not provide evidence that the projects can be completed within the reduced budget.”

It is my firm view that these major projects are not strictly necessary (or should not be at council’s/ratepayer cost) but are included (not necessarily for these exact figures) in the long- term plan and my borrowing graph.

■ Matatā Sewerage Scheme ($22 to $36 million)

■ Plains Water Scheme ($100 plus million of upgrades coming)

■ RMH Project ($100-plus million for what and $65 million of grant funding unlikely)

In addition, the recently emerged Murupara Sewerage Outfall Project at $30 million may not be included in the 2024-34 long-term plan and my graph.

Note also that the RMH project would be included at about $44 million net after hoped for $65 million grant funding.

All of the above major project costings will need to be reworked if the projects proceed and the final borrowing impositions on ratepayers could be anything.

The Matatā Sewerage Scheme is the first cab off the rank and this quote from Tonkin and Taylor included at the end of council’s Water Services Delivery Plan (removed from the council website as of today) is illuminating.

“In general, our review found that the assessed major projects are not considered “gold plated” except for the Matatā Wastewater Scheme, which has been highlighted for further consideration.

"This is based on WDC not currently servicing this township and therefore there is no existing regulatory compliance driver to construct the scheme.

"We note that there are other drivers (growth, community desire and wider environmental concerns) that warrant this project remaining in the budget. The existing $36 million for this project has been left in the budget at this stage.”

If the above projects were halted (or passed directly back to the stakeholders), and the operating deficit was eliminated, council could likely top off its debt at $200 million and fund its necessary forward three waters and other infrastructure capital works from council’s $33 million plus depreciation funding collected within the rates.

If all of the above projects proceed at say $200 million of additional debt then approximately 10 percent of their cost (say $20 million) will come back as increased operating costs related to additional asset depreciation, interest on loans and new asset running costs.

A $20 million operating cost increase represents a 25 percent rates increase on the top of council’s current $80 million rates strike revenue.

This assumes that council will increase the rates for the operating cost impact of these large projects and not simply hold back rate rises and allow further huge increases in council’s operating deficit.

And to eliminate council’s current say $15 million operating deficit (assuming no significant staff and operating cost cuts) would require a 20 percent-plus rates rise for 2026-27.

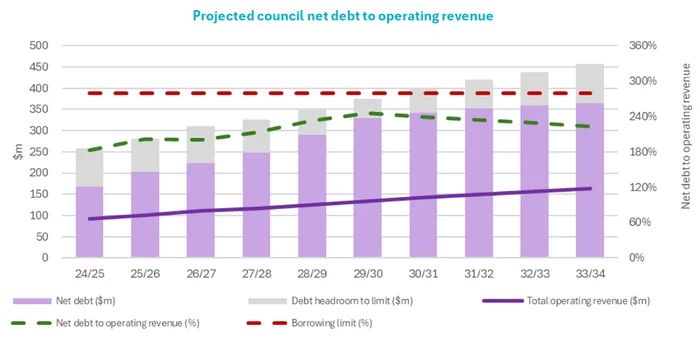

The graph below is an update of council’s forward debt levels as found in the recently approved Water Services Delivery Plan.

With the stroke of a pen council has uplifted is total forward debt levels from $318 million to $365 million, but at least council has removed the contrived forward Three Waters project cost estimates.

This is just a summary of where I see council at today with its debt levels and what is driving the debt.

As the new council comes together I will draw this to its attention, especially as council begins the process of reviewing and formulating the 2026-27 Annual Plan and rates increase.